Edition 08: The State of the Barstool Michigan Sportsbook Experiment

Is the pie growing or is their slice getting smaller?

Good morning to all of our readers, excited to introduce another Monday AM edition of The Handle! This week, we’re focused on Barstool Sportsbook’s status in Michigan and the ups and downs of Penn Gaming’s acquisition of the Stoolie brand.

If you’re enjoying The Handle, please subscribe or DM us on Twitter with any feedback, thoughts, or topics you’d love to see written about!

On January 29th, 2020, Penn National Gaming made waves with their $163 million investment stake in Barstool Sports for an equity stake of 35%, valuing the sports media enigma at $450 million. As their sports betting competitors spent millions on official league, team, and personality content partnerships, Penn opted to take a different route and invest in an already-built audience of bloggers, podcasts, and the pirate ship that has become Barstool Sports. In Penn’s company profile of Barstool Sports, they boast unique monthly visitors across social media, digital, audio, and video channels totaling 66 million. In Matthew Waters’ Legal Sports Report article from May on Barstool’s numbers, he states that a company spokesperson implied the actual number has reached over 100 million active monthly visitors. This core audience has made up a significant portion of Barstool Sportsbook’s earlier customers, which include strong reach to casual and younger bettors. Barstool’s fanbase directly translates a high propensity to watch and bet on sports, as a metric in Penn’s company presentation references that 44% of “Stoolies” bet at least 1x per week.

So has Penn Gaming’s gamble paid off?

The Barstool Sportsbook online betting brand is now live in four states, including Pennsylvania, Indiana, Illinois, and Michigan. In Pennsylvania, Barstool’s market share accounts for ~15% based on Gross Gaming Revenue (GGR = amount wagered - amount won). Barstool launched in April in Illinois trending around ~10% handle & GGR market share. Barstool recently launched in Indiana on May 18th, and while only operational for half of May, opening numbers indicate Barstool raked in a $6.3 million handle.

Today, we’re going to walk you through Barstool’s hot start and regression to the mean in the Great Lakes State, dissecting what was working, what’s not, and the current state of the Barstool Sportsbook Michigan experiment.

Michigan was the second state for Barstool’s entry into the market following their fast-start in Pennsylvania. In the first month of online sports betting in Michigan, Barstool came out of the gates strong and represented 23.9% of Michigan’s handle. Barstool started with a full-court press informal marketing campaign. Michigan residents were given their first-time deposit on the Barstool Sportsbook matched with a donation to the Barstool fund, a fund set up by Barstool President Dave Portnoy to support small businesses during the Covid-19 pandemic. Fan-favorite personalities Portnoy and Dan ‘Big Cat’ Katz paraded throughout Detroit engaging with potential new customers and employing strong boots-on-the-ground marketing tactics to generate buzz while sharing the whole thing on social media. While this approach led to an initially explosive debut for the Barstool brand, the initial buzz has clearly subsided, and consumers have begun to look elsewhere.

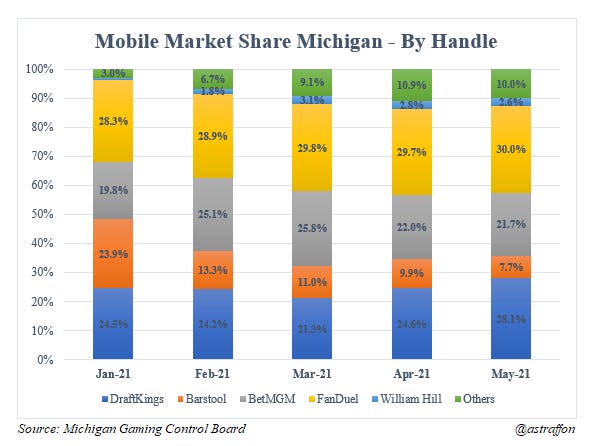

Barstool’s market share has plummeted since, dropping in the following months from 23.9% in January to 13.3% in February, 11% in March, 9.9% in April, and 7.7% in May (h/t Alfonso Straffon).

Unlike competitors in the space, Barstool focuses on internal content creation to promote their Sportsbook rather than spending significant promotional dollars on external partnerships. While Penn was lauded for the lack of promotional spending needed when they aligned with Barstool, strategically this may prove to be a double-edged sword as handle and market share are dropping, and dropping quickly. Penn CEO Jay Snowden said Barstool’s launch spending for their cost per acquisition (CPA) was less than $100 in its first three states for launch, while some competitors report over $500 in CPA costs.

The decline of Barstool is most obvious when comparing April to January, where Barstool saw a decline in handle, despite mobile handle more than doubling across the state. The same phenomena occurred between February and March, where Barstool’s raw handle declined between the two months, even as the overall market continued to grow.

It’s difficult to speculate on why the marketing blitz failed to create sustainable growth, but there are a few explanations we considered. The first is probably the simplest. People don’t bet evenly across multiple accounts, and Barstool simply couldn’t compete once the deposit bonuses and TV ads were in full swing. The second is that Barstool users simply lost money too fast. Barstool posted astronomical hold %s, meaning consumers were losing more, and it is possible they simply couldn’t afford to keep betting at the same rate. The third is that there is something unpleasant about the Barstool user experience, so all the bettors tried out different books, and decided it was easier to bet elsewhere. Of the three scenarios, one and three are by far the most concerning, because they mean that new customers are not “sticky” and have incredibly high churn rates to other books, rather than simply deciding not to bet anymore. No matter what, one day there will be a helluva case study on why the Barstool model failed to attract sticky customers.

That said, we wouldn’t be surprised if there is a potential bounceback in spending and recovery in market share as we enter football season and Barstool’s personalities can reverse course and thrive with endless content possibilities. Regarding public sentiment of Penn Gaming, the NASDAQ listed $PENN stock hit an all-time high close of $130.47 on March 8th. YTD, $PENN is down ~10% trending just above $70 as the market closed on Thursday, August 5th.

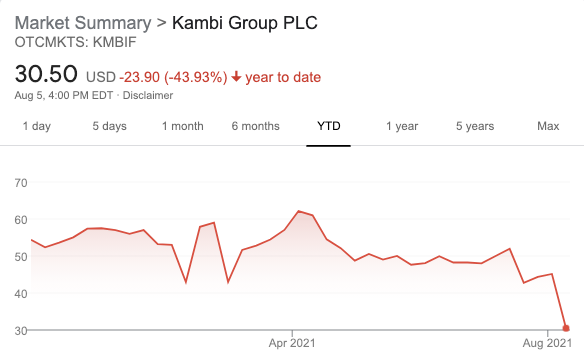

The stock began to recover back to early 2021 levels with the August 5th announcement of Penn’s purchase of Score Media and Gaming in a $2 billion deal consisting of cash and stock. The market reacted to the news negatively, opening down ~6.5% before rocketing up 10% back above $70 a few hours later. Q3 of F2021 saw theScore report a negative EBITDA of $34.5 million with only $16.4 million of revenue so far in this fiscal year. theScore has also had 7 straight quarters of negative GGR. On the positive side, theScore has a large Canadian presence, so expect Penn to leverage their resources in attempts to capture a significant share of the Canadian market following the legalization of single-game sports betting earlier this year. theScore is the largest sports app in Canada and the third most popular sports app in North America, behind only ESPN and Yahoo Sports. This acquisition also provides Penn the ability to move their sportsbook technology in-house and leave Kambi’s ecosystem over the next 18-months, providing Barstool end-to-end integration and full control of their product roadmap. Kambi stock took a massive hit, down ~33% on the day within the first few hours of the market opening at Nasdaq Stockholm. With Barstool moving their tech in-house and following suit of DraftKing’s April announcement doing the same, Kambi’s stock is down ~45% YTD. Kambi’s stock closed on Thursday following Barstool’s announcement just above $30.

Penn CEO Jay Snowden indicated Barstool will be the official sports betting partner of Jake Paul’s next boxing bout against Tyron Woodley on August 29th as well as a live dealer studio in NJ, Barstool digital slots and tables, and Barstool sports bars in Philadelphia & Chicago. Barstool Big Cat tweeted that Chicago will feature a bar location in Wrigleyville. We’ll be following Penn Gaming stock closely while monitoring Barstool’s progress in existing states and aggressive launch strategy including at least five more states with retail presence by the end of 2021 (totaling > 10).

Miscellaneous Recent Consumption:

Press

Really good article by Danny Funt for Columbia Journalism Review on “How gambling swallowed sports media”. One of my favorite reads in a while, definitely worth checking out. Check it out here.

Following up on last week’s piece on sports data, Genius Sports secured a partnership with DraftKings on Thursday including Genius’ official NFL data sports betting feed and real-time play-by-play stats. Draftkings is expanding its live video and official data feeds to over 170,000 events per year with this deal. Within a few hours of the announcement and market opening, $GENI stock is up over 5% while $DKG is up over 3% today. Read more from their press release.

Sporttrade acquired Momentum Sports & Entertainment, obtaining market access into the Colorado market in the first half of 2022. Read more from their press release.

Twitter

Pods

Opportunities

Underdog Fantasy (Brooklyn / Remote) - Product Operations Associate

The Meadows Casino Racetrack (Washington, PA) - Marketing Coordinator

Draftkings (New York City, New York) - Integrated Marketing Associate

Awesemo.com (Remote) - Fantasy Football Youtube Hosts/Analysts

Sports Info Solutions (Coplay, PA) - Product Owner, Sports & Gaming

If you enjoyed reading Edition 08 of The Handle, please share it! We can’t wait to keep pumping out interesting content.

If you have any feedback or comments feel free to DM us on Twitter.