Edition 19: The Cyclicality of Sports Betting

The dependency on football season and its potential impact on sportsbooks

Welcome to Edition 19 of The Handle! This week, we’re going to explore the cyclicality of sports betting and the myriad of questions that go along with that. Enjoy!

Anyone who’s ever taken a rudimentary look at most economic data is familiar with the concept of “seasonal adjustments”, the idea that output and employment may be higher in the summer months, so in order to compare apples to apples across seasons, a seasonal adjustment is necessary.

The sports world, and sports gambling by extension, follow a similar pattern, except rather than the summer being the apex, it is the fall and winter. The most popular sport in the United States is football, both CFB and the NFL. By extension, the biggest gambling markets are college football Saturdays and NFL Sundays. Granted, we’re looking at the United States now, and one look at the limits at sharper international books tells us that there is also deep liquidity in the Champions League, but let’s stay focused on the U.S. for now.

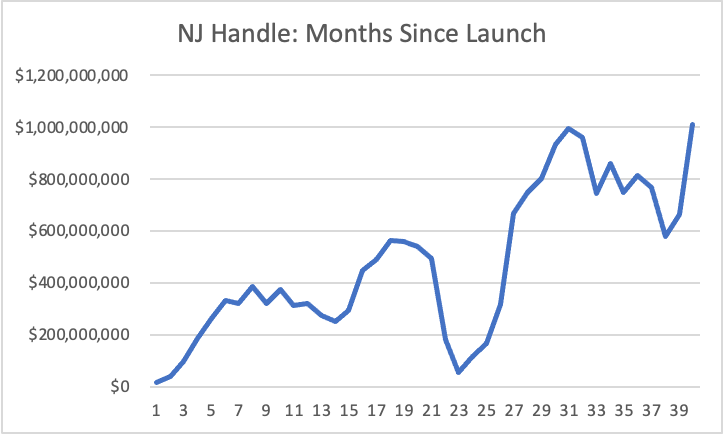

Starting in our home state of New Jersey, which releases reliable handle information every month, we can start to get a sense of the impact that the time of year has on total handle. Starting just in July of 2021, with the market maturing and Covid-19 on the retreat, the total state handle was around $578 million, slightly more than half of the $996 million from December 2020 number, and far below the over $1 billion in handle in September 2021. Even more surprisingly, during the first 12 months of betting in New Jersey, where more books were coming online by the day and the consumer was seeing ads at every turn, the peak in handle was not in a linear increase. Rather, the highest monthly handle was in January 2019, which was still ~$100 million more than the handle 6 months later in June 2019, even as the industry was still seeing exponential growth. It is abundantly clear that New Jersey is greatly impacted by the shifting of the seasons. Now, there are clearly one-off events that have significant impacts on handle. For example, March Madness, a big Connor McGregor fight, and the NBA Finals all have the power to spike gross action at any given time in unison with amplified promotional dollars spent by operators. Check out the graph below (including the COVID-19 drop) to see how much handle fluctuates.

Looking forward at NJ’s handle, October should remain above $1 billion with 5 football weekends within the month, and we optimistically expect that trend to continue through the remainder of 2021. Now, while handle is a sexy number and indicates sports fans in the garden state love to bet, handle is just a proxy for the more important revenue metrics.

Importantly, it’s not just legal books that face these predictable seasonality effects of gaming. We got our hands on some data from a large PPH book and dove into their action breakdown. About 30% of their total handle comes from either college football or the NFL. Including college basketball (which runs from late Fall until March, so still not including the Summer), that percentage jumps to about 45%. We aren’t even including the NBA and NHL in this exercise because they run until the early Summer, but it is abundantly clear that across both legal and offshore books, the plurality of action is occurring in the seasons with the biggest sports.

We asked a PPH backer their thoughts on the swings in action levied on their book throughout the year.

“Throughout the year, we experience a dry season after the NBA finals that runs through the majority of baseball season. Our operation lives and dies with football and everything else is survival. A big weekend in NFL season is worth more to me than a month of baseball inaction” - Backer, PPH book

This is all pretty obvious to someone who is a big sports fan but not a big bettor. We know we bet more on the NFL and CFB than we do on the MLB, and we know it’s not particularly close either.

Implications For The Sportsbooks

Earnings

The easiest and the most obvious is that gross gaming revenue (GGR) and earnings are both a function of total handle, meaning that once we have some non-pandemic years of data from major sportsbooks, we should expect to see near incredible movement between quarters in earnings based on the sports that are played at a given time.

Trading Teams

The second impact is on the traders that these books employ. The more bets a book takes, the more traders it needs in order to keep things moving efficiently. Granted, sharper books will just take anything from a square bettor and not worry about, but let’s assume that handle drops by about half, as we have seen in New Jersey to be about the case. Does that mean books require half as many traders? Where will books get the extra labor? Will this encourage faster technological development and automation as seasonal labor shortages get worse?

How Can Sportsbooks Sustain Elevated Handle: What’s Next?

The third big question is what should books do? Should they embrace cyclicality? Should they try to embrace a sharp book model and look to take serious action on baseball from large syndicates? If they took sharp action, that might help any individual book stabilize its handle. Then again, the hold percentage, if more of the action was coming from sharper bets, would be far lower. I mean, with all the books flush with cash, it definitely wouldn't hurt to see them emphasize some of the emerging summer sports, whether that be the WNBA, the Premier Lacrosse League, or even the XFL/AAF style football leagues. Even smaller sports like table tennis have become significantly more popular since the pandemic began and are embraced by some sportsbooks today.

It’s important to remember that when the AAF failed, that wasn’t a fundamental solvency issue. The league looked like it was going to be cash flow positive! It was a liquidity issue, they simply didn’t have the cash on hand at the time to pay the bills and had to fold. That’s a time when it is in the interest of the sports gaming industry to keep the American sports landscape as robust as possible to maximize all possible sources of handle.

This piece is meant to be exploratory, to raise the question of how big the seasonal changes will be as the industry matures and moves into the post-pandemic era. It’s something very few have directly mentioned, but ought to be exceedingly obvious to anyone with an interest in American sports. We’re looking forward to seeing the creative offerings that come out of these books to help us stay interested in the long summer months where there’s no sports on T.V. besides baseball.

Miscellaneous Content Consumption

Press

The DraftKings-Entain deal negotiating window was extended until Mid-November. Matt Rybaltowski from SportsHandle with more here.

Former FanDuel Co-Founder and CEO Nigel Eccles is founding a decentralized sports betting exchange, BetDEX, he announced via LinkedIn. He is joined in this endeavor with some former FanDuel colleagues, Varun Sudhakar & Stuart Tonner.

On Monday afternoon the NJ Division of Gaming Enforcement (NJ DGE) released their September sports wagering and internet gaming numbers with a record $1.01 billion in Handle and $82.4 million in revenue. More than $400.8 million was bet on football and internet gaming revenue reached $988.7 million YTD with September internet gaming revenue totaling $122.6. David Purdum of ESPN Chalk has more here.

Matthew Waters of Legal Sports Report interviewed the CT Lottery President on the smooth launch of CT Sports Betting. Read more here.

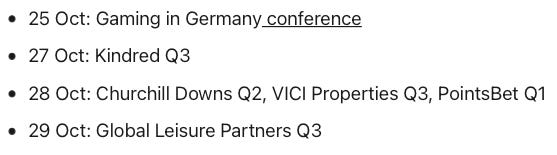

Below is Wagers.com’s Earnings + More calendar snapshot for next week, keep an eye on these press releases:

Pods

On this week’s LSR Podcast, the team dives into the mess that is NY sports betting and updates with CT, FL, and the NFL.