Edition 22: Deductions & Adjusted Gross Revenue: Operators and their tax rates

Should operators be getting away with as much as they do?

Good Morning! This week, we are going to be getting into the nitty-gritty of how revenue works for sports betting operators, what taxable income actually looks like, and how to make sense of the deductions we see operators claiming to lower their tax burdens. After that, we are going to dive in to what promotions we want to see bettors take advantage of. Finally, we’ll do some speculation on how long we think the bonus money can flow and future of promotions. Let’s dive in.

The Basics

In order to understand how bonuses and deductions work, we have to get a bit wonky to understand how revenue comes in for sportsbooks. The easiest way to understand it is to consider something like eBay or another online marketplace. Each transaction they process represents something called “Gross Transaction Volume”, this is the measure of all of the dollars that are used to purchase a good or service on eBay. eBay doesn’t pocket all of that money, rather, the majority of it gets paid out to the seller of the item.

Sportsbooks function somewhat analogously, except they do not have both buyers and sellers. For each dollar that is wagered at a sportsbook, they expect to payout somewhere between about 96 cents to 90 cents, or even lower depending on the hold percentage of the given wager. However, sportsbooks still care about the total number of dollars they offer in bets, and similar to Gross Transaction Volume, they report this metric as “handle” (which is also where our name comes from!). Handle is directly correlated with revenue, but is just the measure of the total amount of money that sportsbooks have taken as wagers from their consumers.

The revenue sportsbooks make comes from the hold percentage. As mentioned earlier, this is expected to be about 4-10 cents of every dollar wagered depending on the book and type of wager. Hold also varies by week. Sometimes, bettors win more than they lose and the sportsbook actually has negative revenue due to the variance of wagering. Over the long term, the house still wins due to the power of the bettor wagering on -110 on a 50% proposition. The money the sportsbook wins is referred to as its revenue, and generally, these revenue numbers are what states are taxing. When you see a state politician talking about sports betting funding going towards schools or roads, they are referring to taxes on the revenue made by the operator rather than on the handle.

The Taxes

Generally, states are so excited to legalize sports betting because of the taxes they think they can make on revenue. State tax rates are usually around 10% with New York coming in at an astounding 51%.

At the Handle, we think the 51% is way too high. Think about it, the operator still has to pay overhead, for traders, for software, and anything else you can think of, in addition to the 51% tax on revenue, before making any profit. It’s not just us who feel this way:

The taxes have made a profound impact on a lot of states. For example, New Jersey, which was the trailblazer in legalizing sports betting outside of Nevada, collected over 36 million dollars in total revenue from sports gambling in 2019, its first year of legalized betting! New Jersey taxes online revenue at 13.5% and in person revenue at 8%, which is far far lower than New York’s 51%. We think taxes should be low enough that operators still want to enter the market and offer consumers competitive odds, but high enough that legalizing gambling helps to add to the state coffers.

The worst idea we have seen is taxing handle rather than taxing revenue, and this is for a few reasons. The first is that it simply encourages books to increase their hold percentage to build in a portion to cover the tax. Now, this happens with revenue as well, but a tax on handle is much easier to pass directly onto consumers by raising hold percentages.

Second, it means that only well capitalized books stand a chance in the market. Remember when we said books could lose in any given time period due to variance? Imagine also having to pay a tax on handle as well. It means that smaller operators are much more likely to get squeezed out of these markets. Thankfully, we’ve only seen this proposed so far, but it’s still something to worry about in the future.

Promos, Deductions and Futures

Starting with futures, these throw a bit of a wrench in the accounting process for most books. Generally, futures are held as winners across one month as there is no pay out by the book at the end of the month if the future is not settled in that month. Later, when the future is settled, it is included as a loss for the book. As a result, hold percentages are artificially inflated in months when major futures wagers are not settled and artificially deflated when something that would settle a major futures wager occurs.

Let’s work through a simple example. If I bet on the Buccaneers last year to win the Super Bowl at +1000 in September for $100, $100 is recorded as a win for the book in September reports. Later, when the Buccaneers lost, my payout would be recorded as a loss in February when the Super Bowl occurred.

Now, we get to the meat of what we think is a bit controversial here at The Handle. Sportsbooks can deduct the cost of promotions from their taxable revenue in some states. These promotions are wide ranging, and you have certainly seen them in ads on T.V. Let’s take Virginia as an example. In Virginia, books pay taxes on adjusted gaming revenue, which allows for the deduction of the cost of portions. Often, this can drop the gaming revenue by significant amounts. Just last month, Virginia’s gaming revenue was around $26 million. However, after promotions and other deductions, only around $10 million of it was revenue that was taxable for the state.

We don’t love this for two reasons. The first is that it clearly is not sustainable for books to be taking around ⅔ of their revenue on deductions. The second is that it is not good for the state to be losing out on significant chunks of the revenue it was anticipating. Sports betting is still new to the scene and needs to remain in the good graces of regulators, and that means making sure that there is no appearance of getting around taxes by spending insane amounts of money on promotions. We would rather see books lower their hold percentages and encourage more action rather than hand out significant amounts of promotional benefits.

All in all, booking sports bets has a far different revenue model than basically anything else. Variance means there will be some losses and some big wins, even if the house always does come out ahead at the end of the day. We look forward to seeing financial markets continue to parse this data and states using the revenue in ways that are productive and beneficial to the broader community.

Miscellaneous Content Consumption

Press

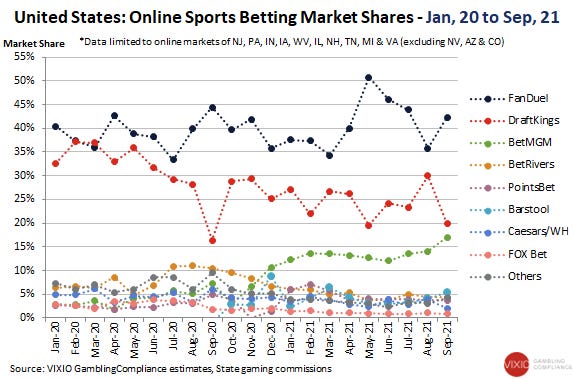

The NY mobile sports betting licenses were awarded on Monday, with DraftKings, FanDuel, BetMGM, Kambi, PointsBet, Caesars, Rush Street Interactive, Genting, and Wynn Interactive making the cut. Matt Rybaltowski has more from Sports Handle here.

Parleh Media Group, a Canadian sports betting media company, raised $1 million in funding led by former Don Best exec Benjie Cherniak and Eilers & Krejcik Gaming partner Chris Grove. BusinessWire with more here.

Check out Earnings+More’s piece from this week on Rush Street Interactive’s Q3 momentum here.

With the selected NY mobile operators announced this week, BetMGM followed up their successful bid with locked-in partnerships including the Knicks, Rangers, and MSG. John Brennan from nyonlinegaming.com has more here.

Twitter

Pods

New podcast out this week from former Director of Product Management at Pinnacle, Jesse Learmonth. Jesse’s pod is called the Betting Startups Podcast, and he will be interviewing founders and CEOs of startups in the industry. Check it out here.