Good morning and welcome to Edition 15 of The Handle! Today, we’ll be exploring the future of fan engagement and its relationship with the sports betting world. First, we’d like to tell you a bit about our friends over at Underdog Fantasy.

Underdog is expanding their offerings with the NBA and NHL season just around the corner, offering Best Ball and Best Puck games to pair with their NFL action. Deposit $10 today using promo code “HANDLE” to get $10 free and join us in leveling up our fantasy games.

Sign up HERE!

In an era of ever shrinking attention spans, leagues and media outlets are looking to connect with a generation used to 10 second videos on Tik-Tok, rather than a grueling three hour baseball game. In an effort to stay “hip” with the younger generation, entrepreneurs have been working to make sure sports stay as viral as they traditionally have been. After all, we are long past the era where the SportsCenter top 10 was the pinnacle of quick fan engagement. So on this fine Monday morning, we are going to dive into some fan engagement products and briefly discuss whether they will in fact engage fans.

The definition of fan engagement is a bit amorphous.

Is throwing tweets up on the bottom of the screen that display a celebrity viewing your event considered fan engagement? The UFC certainly thinks so.

For our purposes, we are going to define fan engagement as anything that makes the watching experience less of a one way street for the transmission of a game onto a television. Using the above example, the UFC showing tweets is an example of a fan engagement initiative because it is allowing fans to interact back with the UFC rather than simply watching the fights. Sports betting companies are in the content and engagement space, and that means competing with social media networks, streaming services, and more for the eyes and wallets of consumers. With that out of the way, we wanted to look at a few of the segments of the market we are most excited about, starting the future of video.

Streaming Integrations

ESPN Alternate Broadcasts

ESPN has been tinkering with and playing around with their content offerings centered around sports betting and live events over the last few years, and they’re more recently being way more open about it. On ESPN 2 this past April, ESPN broadcasted their first live presentation of an NBA game derived from their ‘Daily Wager’ show, displaying live odds, prop bets, and other offerings from Caesars Sportsbook.

With content like this going more mainstream, ESPN is well-positioned to push the boundaries and elevate the live sports betting ecosystem. However, the right people need to be put in places to succeed in order for content to have true value. Media personalities need to understand the nature of markets and importance of high-level, easy to understand bettor education as broadcasting to the masses and gambling-integrated content continues to infiltrate legacy media.

NFL Landscape

The NFL has embraced gambling recently with little to no regard for their hypocritical stance against sports betting over the years.

The league has recently:

Struck a $120 million/year data distribution deal with UK-based Genius Sports over six years, giving Genius the right to distribute live audiovisual game feeds to sportsbooks.

Announced first-ever U.S. sportsbook partnerships with Caesars Entertainment, FanDuel, and DraftKings.

Announced agreements with four approved sportsbook operators for the 2021 season (FOX Bet, BetMGM, PointsBet, WynnBet).

Through the first 3 weeks of the 2021 NFL season, sports betting has become indoctrinated into the live NFL viewing experience in a way we’ve never seen before. Point spreads and over/under totals began scrolling on the bottom ticker of the TV screen for the first time. While it’s now openly a part of the broadcast and there has been a massive increase in gambling ad spend, the NFL has requested its media partners avoid addressing gambling related content on air.

We hear you, Dustin. Give it a season or two and sports betting will be fully integrated as the NFL decides it’s convenient.

Buzzer

Buzzer is an app which proves “a seamless user and viewing experience” through the aggregations of live sports streaming rights, attempting to infiltrate traditional OTT providers and appeal to the “House of Highlights” generation. Founded by Bo Han, former director of live content for Twitter, Buzzer has raised $24 million with stars like Michael Jordan, Wayne Gretzky, Patrick Mahomes, Naomi Osaka, and many more athletes backing the app who has already partnered with the NBA, NHL, PGA, WNBA, and more.

How can Buzzer change the way fans engage with sports betting products?

Buzzer’s mission to engage younger, mobile-driven fans aligns directly with operator goals of converting these viewers to depositors and retaining them as bettors as they reach legal gambling ages. We’re intrigued to see who is able to partner with Buzzer and how their unique approach to acquiring rights and content impacts the sports betting engagement and brand partnerships.

Emerging Platforms

Betcha

Betcha describes itself as “If betting, fantasy, twitter, and eSports had a baby”, which is both ambitious and a bit ridiculous for an app that only has about 100 reviews on the app store.

The gist of Betcha is simple, some parts microbetting mixed with social functionality. Users can acquire badges similar to phone games, and they are claiming there will be a public leaderboard. Additionally, users can communicate with their friends about the wagers they have placed and the games they are watching.

Generally, people seem to be excited about Betcha, but for a company that prides itself on being connected with Gen-Z, withdrawals only being available via check is a massive buzzkill (or digital cards?). Ever heard of mobile banking? We know Betcha is still growing, and are hopeful this will change in the future. Betcha would certainly benefit from growth, which would allow the social part of the app to flourish. Our verdict here is very much to stay tuned, as we think this could be exciting.

Telescope Inc

Telescope Inc. is a leading real-time fan engagement solutions provider for live events, gamified second screen experiences, and interactive livestreams. In August 2021, Telescope was acquired by Bally’s Corporation (NYSE: $BALY) to amplify Bally’s omnichannel interactive product suite and allow Bally’s to connect to a younger audience in new, innovative ways. Telescope’s traditional use cases include customized online voting experience (think NBA All-Star Vote), live streams with customer graphics, and other sweepstakes contests and unique content offerings we’re curious to see Bally’s integrate with their sports betting products.

BettorView

BettorView is a self-described media platform aiming to activate the world of sportsbook entertainment at your sports bar. BettorView has partnerships established with NASCAR, Caesars, Hooters, the 76ers, amongst other entertainment venues. Their experience has led to an increase in odds, stats, and analytics shown on screens in arenas, sportsbooks, and sports bars in legal betting states.

Venue Experience

Listen, there’s no question that the future of sports betting is digital. Online wagering makes up the majority of handle in every state where it’s available, but that doesn't mean there isn’t room for effective retail options if done properly. There has been a shift along with the uptick in legalization efforts across the country for sportsbooks and venues to partner and create in-arena experiences to engage their fans and offer a more dynamic sports betting experience.

A few of the following have been among the first movers creating said sports betting lounges, and we’re looking forward to visiting these locations and seeing what they have to offer. We strongly believe the synergistic relationship between sports betting and attending games and events will allow engagement opportunities like this to prosper and enhance the viewership product. Here are some in-venue sports book experiences announced already:

Fubo Sportsbook at Metlife Stadium (New York Jets)

BetMGM at State Farm Stadium (Arizona Cardinals)

Fanduel at Footprint Center (Phoenix Suns)

Caesars at Chase Field (Arizona Diamondbacks)

Barstool Sportsbook at Phoenix Raceway, TPC Scottsdale

William Hill at Capital One Arena (Wizards, Capitals, Mystics)

Overall, the increased exposure and ability to offer retail tickets without leaving a venue could serve fan interest and engagement in a unique way. We’re excited to follow the successes and failures of venue sports betting entertainment and tech over the next 18 months.

Conclusion

To put it simply, there is no better time to be a sports fan than today. Whether it be a sportsbook at an NFL stadium, an odds ticker on the bottom of the screen, or new apps to connect with friends during the game, the possibilities on the landscape seem limitless. Some will undoubtedly fail, and some will become unicorns but that is the beauty of entrepreneurship. We’re excited to see what succeeds, and for our viewing experience to get even better.

Miscellaneous Recent Consumption

Press

DraftKings ($DKNG) has submitted a $20 billion cash-and-stock proposal to acquire Entain ($ENT), the UK-based company which owns 50% of BetMGM as well as Ladbrokes & Coral. The U.S. market did not react kindly to the update, with $DKNG down ~5% on the day while $ENT is up ~18%. DraftKings market cap is currently $21.67 billion, which makes you wonder where the capital is coming from for such a large-scale takeover.

Extreme Networks’ Wi-Fi network solutions and analytics deal through 2024 with the NFL has implications for in-game betting. Matt Rybaltowski from Sports Handle with more here.

Boom Entertainment (formerly Boom Sports) announced on September 20th that they raised $15 million in a Series A funding round, led by Sands Capital, Golden Nugget, Rush Street Interactive, Bettor Capital, and other notable companies and individuals including NE Patriots owner Robert Kraft and former MGM Resorts CEO Jim Murren. Check out their press release here.

Brad Allen published a deep dive on why offshore sportsbooks are thriving despite regulated competition. His piece had some really interesting insights, check it out here. YTD Bovada is the most-searched brand among US-facing books at a 19% share with Draftkings at 11% & Fanduel sitting at 9%.

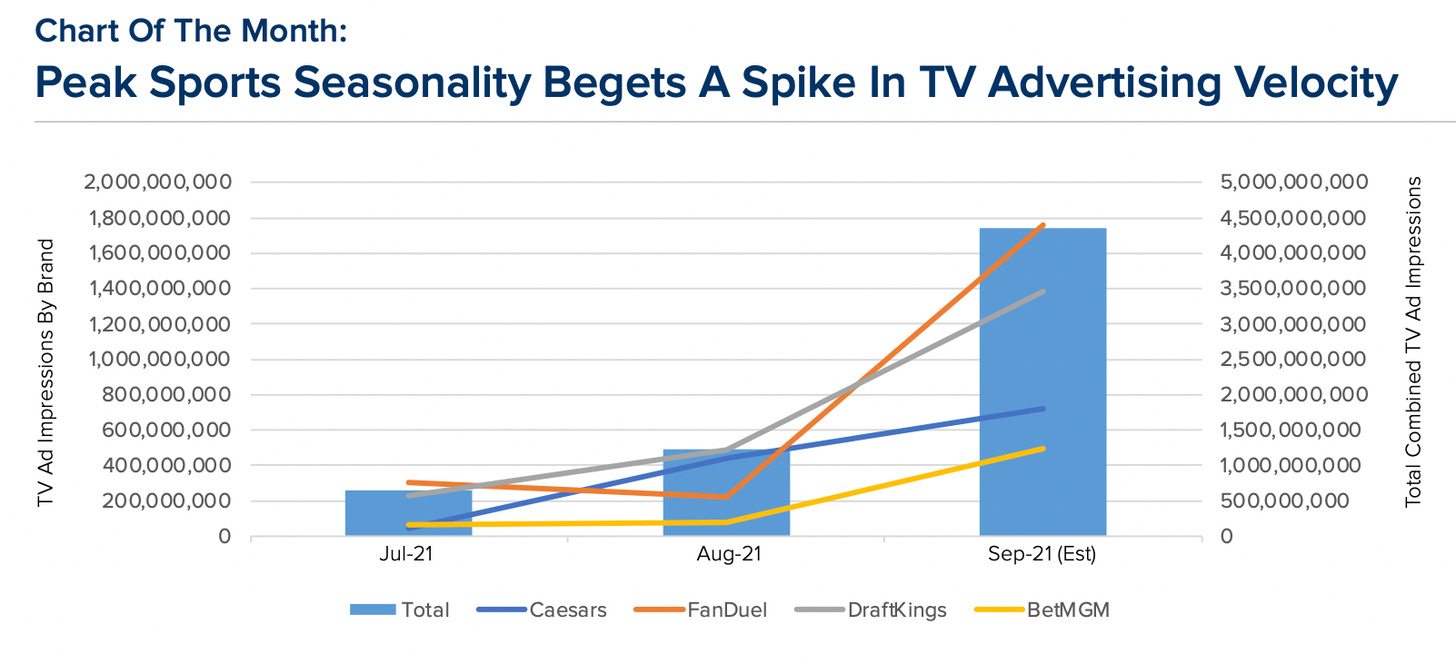

Fanduel and Draftkings are massively increasing advertising with the start of football season. This chart is courtesy of Eilers & Krejcik via Wagers.com’s Earnings+More newsletter.

Pods