Edition 21: The Bull and Bear Cases For NFTs

Are NFTs a roulette wheel or legitimate investment?

The NFT world is closely tied into the sports betting world on a myriad of levels; similar risk profile, WAGMI (We all gonna make it) mentality, and most importantly an overlapping group of prominent early adapters. There are strong parallels regarding massive influx of capital and newfound mainstream prominence, yet both the sports betting and NFT world are in the top of the second inning in terms of market maturity. Crypto exchange FTX’s CEO Sam Bankman-Fried said that data shows sports fans are 2x more likely to know about crypto than non sports fans and avid sports fans are nearly 3x as likely.

This week, we’re going to cover our thoughts on the market and present both a bull and bear case. Spencer and our staff writer Daniel are taking the bull, while David is taking the bear.

Non-Fungible Tokens (NFTs) are defined as unique and non-interchangeable units of data stored on a digital ledger. What does this mean? NFTs are tokens which can be used to represent anything, acting almost as a public certificate of authenticity and ownership.

Without further ado, let’s dive in.

The Bull Case

The public and transparent nature of the NFT market allows for a unique combination of digital ownership, scarcity, and credibility. Think of skins in Fortnite: millions of people pay to change their character’s outfit or accessories with no added benefit to gameplay in the battle royale behemoth. They provide clout, status, and make you feel good, showing that the traditional definition of “utility” in the economic sense may not be exhaustive! People pay thousands just to make their character in a virtual world look cooler. NFTs have the ability to offer so much more keeping a long-term view and investment thesis in mind, and the growth in adoption and popularity is reflected in Q3 NFT sales booming to $10.7 billion.

Let’s explore some different facets of NFTs and some projects innovating within each sphere.

Utility

A crucial element in the long term success of NFT’s is the utility they provide. At the end of the day, the strongest projects will provide utility to their token owners in the form of internal and external rewards. Value will extend beyond just the exclusivity of owning the NFT through exposure to experiences or opportunities, early access to products (or mint passes), IRL events, dividends, or airdrops to long term HODLers. The possibilities are endless, and creators and thinking of new ways to provide utility to holders on a daily basis. Think of the my player game mode in NBA 2K where, as you progress, you gain more VC (2K form of currency). With more VC, you are able to improve your player and unlock unique opportunities. With more blue chip companies getting involved and innovation occurring in real life and the metaverse, the ways for projects to deliver unique utility catering to consumers' every wants and needs are exploding.

Now, in terms of individual utility, each project is finding their own path to connect and give their users the best experience possible. For NBA Topshot, they have had multiple events for completing specific challenges. These have included tickets and all access experiences to the NBA Finals, the NBA Draft, and opening night Bucks versus Nets in Milwaukee. They know their LOYAL fanbase cares about basketball, and would find enormous utility out of an experience like this. So, they reward the fandom and not just flippers looking to make a quick buck by providing unique collector experiences. Just last week, NBA Top Shot Collectors accessed an event in NYC where Top Shot partner Quavo performed. The plethora of investors and celebrities involved with Top Shot’s company Dapper Labs leaves us excited and curious where the collector opportunity will transition next. Will top Knicks moment holders have access to free tickets, merchandise, and memorabilia? The possibilities are endless.

Similarly, other projects have experimented with other methods. For example, Mutant Cats have created their own currency $FISH which can be earned by staking a Mutant Cat. The more $FISH one earns, the more fractional ownership they gain over the “Vault”. This is a way to reward holders with a form of passive income. Here is an article providing a bit more on the concept of staking with respect to NFTs. Finally, Zed Run, the premier NFT horse racing game has found a direct way to provide utility from champion horses by having entry fees on the races and through breeding. If one comes across a phenomenal male horse, they can collect winnings off not only races, but also stud fees (female horse owners paying to breed with the male, yes I know how crazy that sounds). Two top horses, Billion and Ducky Mallon have respectively made profits of 4.6122ETH and 8.9911ETH just off racing, that doesn’t include the enormous stud fees you can charge to obtain some of their prized blood. Here’s an interesting read on the utility of Zed Run.

DAOs

DAOs, or Decentralized Autonomous Organizations, are a newer phenomenon within NFTs providing users with opportunities to pursue expensive projects or investments by pooling money together and forming an organization. As Cooper Turley put it, “a DAO is an internet community with a shared bank account.” DAO’s range in mission, structure, roles, and funding depending on the end goal. Regardless, it garners a sense of community, and opens doors that an individual on their own could not achieve.

What makes DAOs so unique is the structure which strays from the typical hierarchy of a company. There isn't a CEO, CFO, or CBO; instead DAOs are decentralized where they aren’t governed by one person or entity. The rules are coded into smart contracts on the blockchain and therefore they can’t be changed unless voted on by the members of the DAO. This gives every member an equal say in accordance to their shares of a DAO token and promotes unity among the group. There is also tremendous transparency within DAOs which is appealing to many. Nothing is done without the idea being pitched, discussed, and voted on by group members (usually in a Discord server).

Recently, they have drawn attention from famed personalities such as Mark Cuban, and prominent Venture Capital firms like Andreessen Horowitz (a16z). Cuban described them as, “the ultimate combination of capitalism and progressivism” while a16z has led multiple million dollar funding rounds around creating DAOs and supporting companies that build DAOs.

On a personal note, Spencer and I recently got involved in the Knights of Degen Community by minting three Knights apiece. The Knights community functions as a form of a DAO. As a perk of ownership we get to partake in votes to determine how to spend the “King’s Purse”. This could be whether or not we (as a group) want to acquire a new NFT, Top Shot Moment, or bet on Daniel Jones over rushing yards. Nothing is done without discussion, and a vote. Another recent development is the Knights acquired a Fan Controlled Football Team. So, we are now fractional owners of a professional sports franchise through a DAO!

The Metaverse

Shaan Puri describes the metaverse as the moment in time where our digital life is worth more to us than our physical life. Puri points out that every aspect of our life has been moving away from physical and toward digital over the last 20 years, including the following:

In Packy McCormick’s latest Not Boring Newsletter, he dove into Facebook’s rebrand as Meta and Mark Zuckerberg’s plans to “contribute to the open, interoperable Metaverse”.

In Zuckerberg’s interview with Ben Thompson, he explains his goals to increase the GDP of the metaverse as much as possible while maximizing the potential of individuals and corporations to leverage the creator economy through innovative experiences. Creators can utilize their platform to allow creators to own their data, royalties, and connect on-chain with their communities with full ownership and transparency. Meta owns one of the largest VR companies in the world, Oculus, and will push the boundaries forward to merge the future of the digital and physical worlds.

Meta’s announcement represents the tip of the iceberg for metaverse innovation and interactivity, with plenty of other use cases brewing including digital land, play-to-earn gaming, and more. Below is a cool visual encapsulating the many companies building toward the digital future (Source: Activate Consulting 2022 Tech & Media Outlook).

This past week, Nike announced new trademarks with intent to create and sell Nike-branded virtual items in the metaverse. The cross-section of institutional capital from brands with decades of proven staying power as well as the power of individual creation leaves me bullish on the future of the metaverse.

Web3 Creator Economy

Institutional celebrity status doesn’t hold the same weight as it does in real life. Fame, fortune, and notoriety are built through time in the market and organically built communities. Artists and collectors alike are publicly interacting across Twitter, Discord, and Telegram with all touch points of their ecosystem and, most importantly, their followers. The interconnection between common people and celebrities is made possible through the access social networks provide to the trailblazers of the NFT movement.

The creator economy is evolving from social media influencers utilizing Youtube and Instagram to create ad revenue to Web3 allowing for community ownership. The below thread from Li Jin captures this idea perfectly.

Creators can build communities and empower their stakeholders with secure, public contracts directly to consumers without the need to go through third parties. With the ability to connect with fans and customers, the Web3 creator economy is a building block for wide scale value creation and new forms of engagement for years to come.

What Will Survive?

While bullish on NFTs and the blockchain’s ability to unlock digital interaction and change the way we live our lives, we’d be naive to think most or event a reasonable fraction of projects will last. 99.99% of projects created in the space will likely cease to exist, much less thrive, in the next 5+ years. Most will fail. However, overlooking the industry as a whole demonstrates a lack of open-mindedness regarding the speed of technological innovation and adoption. Take a look at Web2, the stage of the internet where software and value were created at warp speed online in the past few decades. For every Snapchat, Airbnb, and Uber there are millions of apps and websites which fizzle out.

So what will last?

My theory on this is that lasting projects will be made up of historical projects and innovative companies delivering long term value through real-life utility and overwhelmingly strong communities. Let’s take a look at a few examples of each.

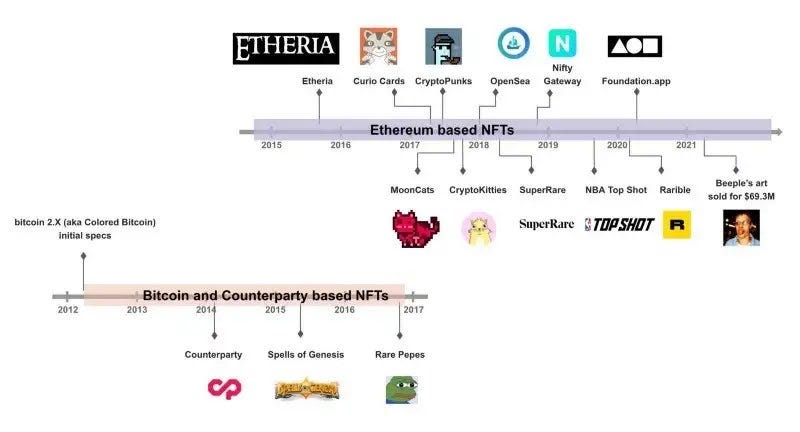

The below graphic includes a visualization of relevant crypto art’s timeline.

CryptoPunks

CryptoPunks by Larva Labs are 10,000 randomly generated 24x24 pixel 8-bit-style characters, released in 2017 and claimed for free

All-time there has been > $1.5 billion in sales volume

May 2020 -- Christie’s auction sells a bundle of Punks for $16.9 million

Many celebrities and early crypto maxis don their Punk on Twitter as a symbol of brand identity, ranging from anonymous investors ingrained in the community (Punk 4156, Punk 6529) to the likes of Odell Beckham Jr. and Jay-Z

Read more info on TechCrunch: The Cult of CryptoPunks

Historical Projects

Curio Cards

Curio Cards are the first art on NFT, consisting of a unique set of cards by a collection of artists (predates CryptoPunks)

October 2021 -- Christie's auction full set sold for $1.26 million

Individual artists: XCOPY, Beeple, etc.

XCOPY is an anonymous, London-based crypto art OG

Began minting NFTs on SuperRare in 2018

Known for flashing-style imagery, XCOPY has sold art for millions of dollars

Beeple, or Mike Winkelmann, sold an NFT at Christie’s for $69 million

The piece consisted of 5000 NFTs he produced daily since May 1st, 2007

Generative Art

Check out Fidenza, Ringers, Chromie Squiggles and more here.

Newer Projects With Strong Community + Utility

The Bear Case

David here to write the bear case. I usually am the more bearish of the two of us, to the point where Spencer has actually called me the “fun police”. I know NFTs are quite popular in the sports gambling community, and I know that NFTs really can make you life changingly rich. I’m not going to dispute that, but rather I am going to go through a few arguments in what I hope is an intellectually honest way about why I’m not as bullish on NFTs as the rest of the world seems to be.

I’m also not going to get into the different classes of NFTs, or address any of the non-systemic issues. Obviously, there will be creators who take money and run, hackings which result in stolen NFTs, and any other scam that could possibly be conceived. These are all very real, and very serious reasons to be wary of NFTs. Instead, I am going to be focusing on the inherent risk that comes from trading NFTs and the very real risks to value that exist in the NFT universe.

The main argument comes from an old professor of mine, John Geanakoplos, who taught me financial theory and who has an incredible paper / model on the leverage cycle and the importance of collateral. Luckily for all of you, I won’t be deriving the model and just focusing on a few key elements that I think map well to the phenomena we are seeing with NFTs. In Geanakoplos’ model, the price of an asset is determined by the marginal buyer on a scale of “very pessimistic” to “very optimistic”. The more optimistic the marginal buyer is, the higher the price of the asset. His paper looks at collateral requirements and how that affects the price of assets, but we can also use the price of crypto.

Generally, those who have been incredibly involved in crypto during its massive bull run are the same early adopters of NFTs. As the crypto bull market continues, these buyers have more wealth that they can then spend on NFTs, which they will as they are the biggest “optimistic” in the market (not getting involved with people who use bitcoin as collateral for lending, but also a real issue). In short, higher crypto prices drive up demand for NFTs by making the marginal buyer of NFTs more optimistic. Unfortunately, this means there is significant downside risk in the case of an exogenous shock where the price of NFTs and crypto falls rapidly. In this case, the early adopters will likely try to get out with some profit remaining. This means that the marginal buyer becomes less optimistic as the super optimists are forced to sell because of an exogenous shock in order to secure a profit. The increase in selling and the marginal buyer becoming less optimistic create a positive feedback loop that puts a negative pressure on the price with no clear bottom.

Now, the potential hole in this argument comes from long term holders that Spencer mentioned earlier. These are the people who would never sell, in theory. I have a few problems with this. The first is that utility ultimately still comes from consuming goods in the world. Consumption in the real world is still based on USD, which means that if there were to be a crippling shock in the crypto world, people would still flee to the dollar. The second is that the IRL events that Spencer mentioned come from the money made during positive times. Those are not free, when push comes to shove, those will be the first to go from NFT communities. Not only does this reduce the utility of owning the NFT, but it also creates an incentive to sell because it gives the appearance that insiders are not as confident in the pricing power of the token once they stop hosting the events and dealing the perks. This means that in the event of a large negative exogenous shock, I still see even the most long term holders selling at least part of their NFT holdings.

With that said, NFTs are prone to exogenous shocks for three key reasons in ways that other assets are not.

The first is that they are not priced in a stable currency, but rather in cryptocurrency. As a result, there are two sources of underlying volatility in NFTs, whereas in traditional assets there are only one. Arguments that cryptocurrencies are less volatile than the U.S. dollar, at this time, are not intellectually honest and should not be treated as such. These two sources of volatility increase the risk of a massive exogenous shock putting downward pressure on price.

The second is the nascent regulations in the entirety of the crypto industry. Right now, the financial authorities and Gary Gensler (SEC chair) are reviewing their authority and options to monitor cryptocurrency. As a result, there is a decent chance that these regulations will not be favorable to crypto, which could drive money out of currencies. This would drive down the price of NFTs that are priced in the cryptocurrencies that investors are fleeing from. Along these lines, NFTs have the potential to create two separate taxable events in transactions. First, when the NFT is sold after appreciation, the sale of property generates a taxable event. But, if marking to market, the underlying price of the currency has grown as well, that also represents a taxable event when they currency is sold. This double taxation increases the risk of liquidity issues.

The third issue is that with crypto, there is no lender of last resort. In the event that Coinbase, or another large cryptocurrency exchange faces a liquidity crisis, the Fed is not going to provide them with liquidity in the same way a traditional bank can survive a liquidity issue. The failure of a cryptocurrency exchange, for one reason or another, would force consumers to take massive haircuts, and seriously undercut trust both in the NFT market and in the broader crypto market as a whole.

These are more systematic issues with NFTs, although I’m sure I could give examples of people being on the wrong side of wash trading, pump and dumps and other associated scams that would also dampen my personal enthusiasm to buy NFTs. Further, I’ve never been an art guy which I suppose extends to NFTs as well, but I’m not as keen on the arguments that say a share of pixels is inherently less valuable than a 200 year old canvas with some paint on it. Happy to discuss these arguments and more. I know people have made a lot of money on NFTs and I know that they will likely be part of the ecosystem for a long time to come, I’m just pointing out that along the way, the inherent falls in price for NFTs are going to be much much sharper than I think a lot of people realize.